“Yes!” to the Billionaire Tax, and Why We Must Redistribute the Wealth of the Ultra-Rich

8 min read

With the one-time 5% wealth tax on billionaires coming to a vote in California this November, it’s worth examining why such an idea was proposed in the first place, why the ultra-rich are against it, and why many believe it’s morally necessary.

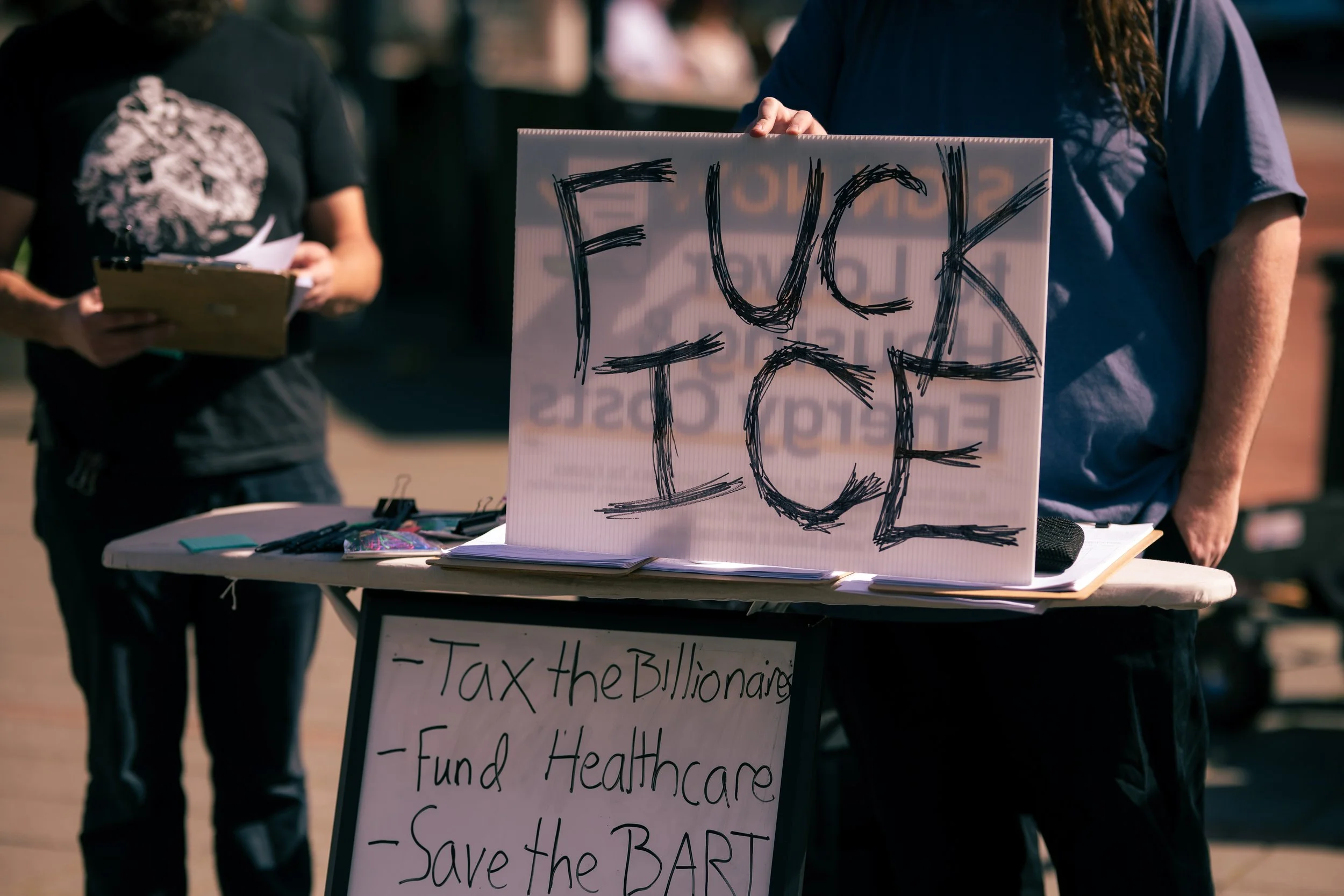

Trump’s “One Big Beautiful Bill” slashed taxes for the wealthy by obliterating public programs in the U.S. like SNAP, Medicare and Medicaid, leaving states like California with a massive budget deficit for healthcare, roughly $20 billion. If that deficit is not filled, approximately 1.6 million low-income Californians will lose their health coverage in a state with the fourth-largest economy in the world. To address this, the United Health Workers teamed up with economists, politicians and academics to develop what is now known as the Billionaires Tax, a one-time, 5% emergency tax on the wealth of the roughly 200 billionaires in California. The revenues collected from the tax (about $100 billion over the next five years) would go directly into a fund in which 90% must be used for public healthcare, and the other 10% for public education. A more thorough accounting of what the bill entails can be found here, but suffice to say, it is incredibly generous to the ultra-rich and excludes personal real estate holdings and income.

Many of California’s billionaires are upset with the proposed bill and will continue to express their grievances through their immense influence and resources within the coming months. The tech billionaire Peter Thiel has already spent millions campaigning against it, and many are threatening to leave the state if the proposition passes. Gavin Newsom, who has killed similar projects in the past, has vowed to fight the initiative, although he cannot veto a popular vote proposition.

The most common argument opposing the bill, often repeated by politicians and billionaires alike, is that the ultra-rich already pay more than their fair share of income taxes, contributing greatly to the state budget by doing so. While it is certainly true that those in the 1% bracket of wealth in California contribute 38% of the state’s income taxes, those figures are not representative of the billionaires themselves. For instance, the 1% in the California tax bracket consists of 175,045 households with an average gross income of $2.6 million. That is a number of households far exceeding the 200 billionaires in California, and in fact, likely makes up many of the employees of their companies or industries. Due to corporate write-offs and exceedingly flexible tax laws, billionaires can often avoid paying virtually anything in taxes (aside from property taxes). Therefore, these billionaires represent a small fraction of the 1% that make up the massive 38% figure, and with average gross incomes in the “low” millions, the 200 billionaires pale amidst the thousands of tax-paying millionaires in the state.

This leads us to the second major opposing argument of the bill: if taxed, billionaires will pull their capital out of the state, and perhaps many of those that make up the 1% as well. The idea is that if billionaires leave, so does their capital and their companies, which then pulls many of the 1 percenters relying on those industries. Yet this is also unfounded. While billionaires like Thiel have purchased houses and moved capital to other states, the heart of their businesses remains in California. The state stands tall as a tech and finance hub, with growing evidence to support that moving such businesses and assets out of the state is exceedingly difficult and unlikely to happen. So, despite what Governor Newsom has said, billionaires are not contributing their fair share (unlike millionaires, middle class, and low-income residents). Their companies are contributing much to the economic health of the state, it’s true, but those companies are very unlikely to go anywhere anytime soon, even if their founders are, or are threatening to.

Philosophically, billionaires largely oppose a wealth tax on the same grounds the ultra-rich always have: that the government has no right to forcibly take a portion of their well-earned funds, even for public distribution. Their view is not particularly unique either, as many Americans who are not rich tend to share decidedly libertarian views on personal wealth and the free market. The libertarian view holds that to violate one’s wealth is to violate one's liberty, and therefore unjust, regardless of the reason. This notion goes all the way back to our founding as a nation and the historically unfavorable way in which Americans have viewed taxes. There is a deep vein of belief in this country that one keeps what they earn, and earns what they keep. They succeeded in a meritocratic society, rose to the top by the strength of their character, and are now the best and only authority to rule over their earnings. However, the libertarian philosophy is flawed, as is the popular conception of the free-market economy that ties into it.

When thinking about the sanctity of liberty involving wealth, most tend to focus on the wealthy and less so on the majority of those struggling to scrape by. A modern nation cannot be ruled by the holiness of personal liberty alone; a state like ours consists not just of individual liberties but a collective liberty as well. When an industry like banking takes advantage of millions of Americans in the housing market, and then crashes said housing market through their greed, they violate both the liberty of the individual and the liberty of the collective. The rights of both the individual homeowners and the masses of American consumers are breached, so if the public then wants to pressure Congress to force executives who received massive bonuses post-bailout to return the bonuses (thus violating their liberty), they can. The individual financial liberty of a few cannot come at the expense of the collective liberty of the many. In that system, wealth must be redistributed to the masses. How is wealth redistribution an infringement of individual liberty when the lack of such redistribution fails to correct a system that routinely devours the individual and collective rights of the vast majority of the state?

Free market capitalism is a system that preys upon and financially enslaves most of the population, with a select few able to amass enough resources to exert control. The reapportioning of billionaires’ resources infringes upon their individual liberty, yes, but it does so to aid the masses of citizens who, due to the unchecked power of the “free market,” are unable to gather the resources necessary to protect and preserve their own liberty. Regardless of the industry, all operate within a broader economic system of free market capitalism, which perpetuates many of the same cycles of exploitation and unhealthy power dynamics, whether it's banking or, for many of California’s elite, tech. Additionally, the term “free market capitalism” is misleading. If left unchecked, as ours has, it will sprout an unbalanced power structure in which a few economic agents hold a disproportionate amount of power within that system. The price of goods, for instance, will not merely cost what consumers are willing to pay for them, but what they are forced to pay for them.

Healthcare, a private industry in the U.S., is a great example. The corporate consolidation and monopolization that has occurred has made it so that a select few corporations can set the price for services, and the Americans who rely on that non-negotiable health care are forced to pay it. That kind of control over the industry has a real and devastating impact, with 66.5% of personal bankruptcies listing medical debt as the cause, according to Cornell’s Scheinman Institute. Approximately 26,000 Americans die every year from a lack of health insurance, as cited by the National Library of Medicine. If the free market from which the ultra-rich amass such great wealth is not truly free, and in fact routinely violates the sovereignty and liberty of the masses to increase wealth, then how are we (the people and state) not justified in transgressing the individual liberties of the wealthy few to rebalance the scales of power?

Keep in mind that the taxes levied to redistribute a proportion of their wealth affect their power, not their quality of life. Because taxes on the general population take money that otherwise would have increased their buying power for necessities, taxes on the rich affect their buying power for non-essentials. They still have their home (many homes, in fact), they can still afford to clothe themselves in expensive fashions, and they can more than afford to keep themselves well fed. Any extracurriculars like travel, sports, or the pursuit of the finer things in life are more than well-funded. It is only their power that is being taxed, not their ability to live lavishly. Taxes that force a redistribution of wealth are thus necessary for the health of our nation, as they help to rebalance the scales of economic power so often tipped against the majority of Americans. Crucially, they also remind the ultra-rich that their wealth is not entirely amassed by effort alone, but instead by a system that is designed to benefit them and subjugate the rest. Libertarianism and a belief in the free-market economy are often predicated upon an idea that those within the system have equal agency, but that is rarely (if ever) true. If we want to mend this system, or at the very least use its resources to benefit the general population through things like state-funded health care, we must view the system for what it really is, not how we wish it were. The billionaires in California, and throughout the country, have the resources to improve the lives of the public, and if they won’t distribute some of their wealth voluntarily, then the state and the people must do it for them.

If you choose to endorse the Billionaire’s Tax Act, click here.